Atrium Health Floyd provides you with access to comprehensive Dental coverage, including routine care such as annual exams and cleanings to more extensive services such as dentures and braces.

Did you know that good oral health is part of your overall well-being? Dental issues can actually lead to more serious health problems, including heart attacks and strokes. Take care of your teeth and gums.

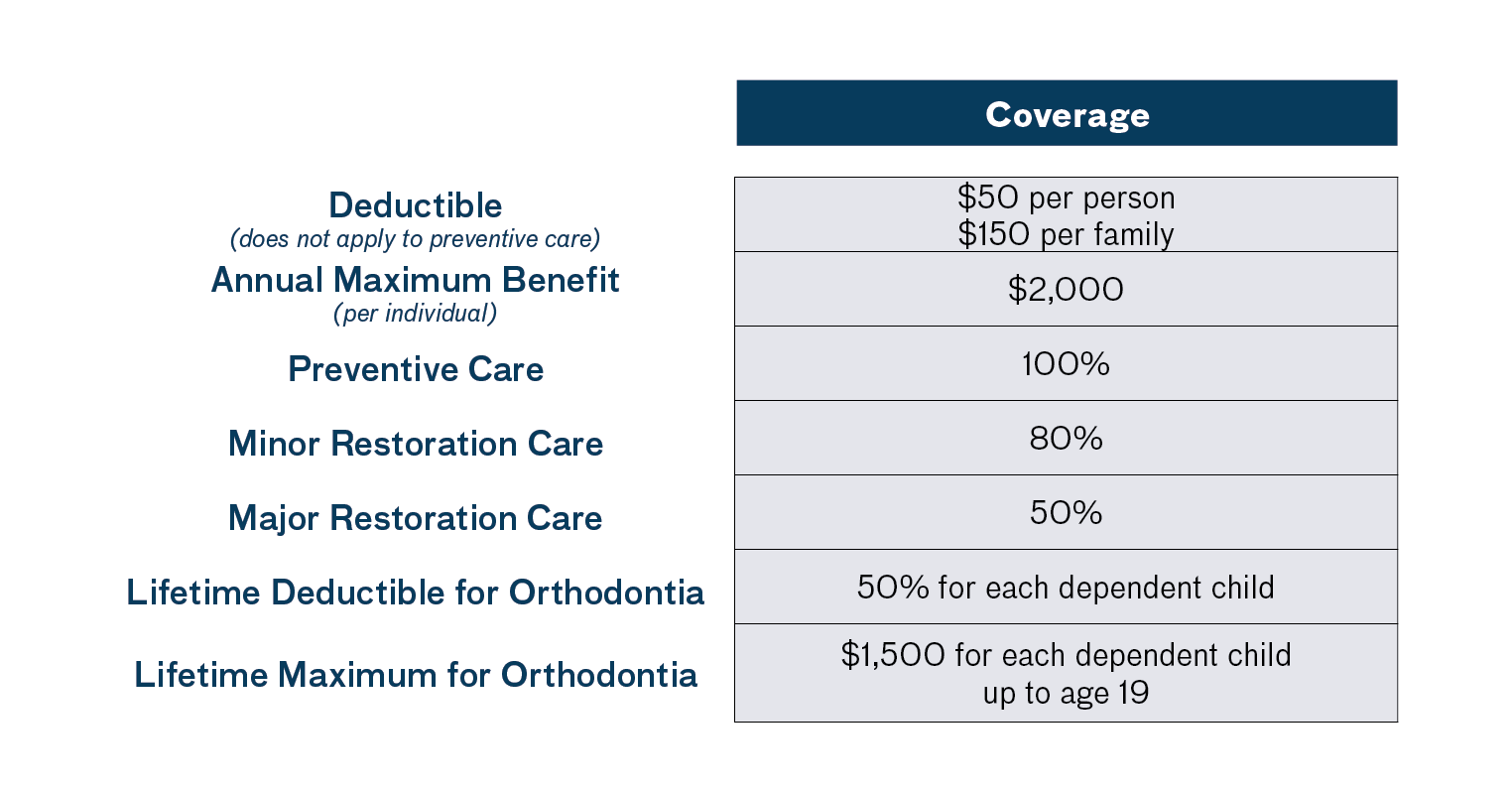

Because it’s important to maintain dental health, dental plan coverage is available to you and your covered family members. Dental plan services include:

Pre-treatment Estimates for Dental Care

For certain high-cost dental services, your dentist may want to submit a pre-treatment estimate to Cigna. You and your dentist will be notified in advance of the amount the dental plan will pay for the treatment. This gives you an opportunity to discuss the charges and benefits with your dentist before you receive any treatment. No pretreatment estimate is required for emergency care.

Dependent children up to age 26 are eligible for coverage in the dental plan, but orthodontia services are available up to age 19 only.

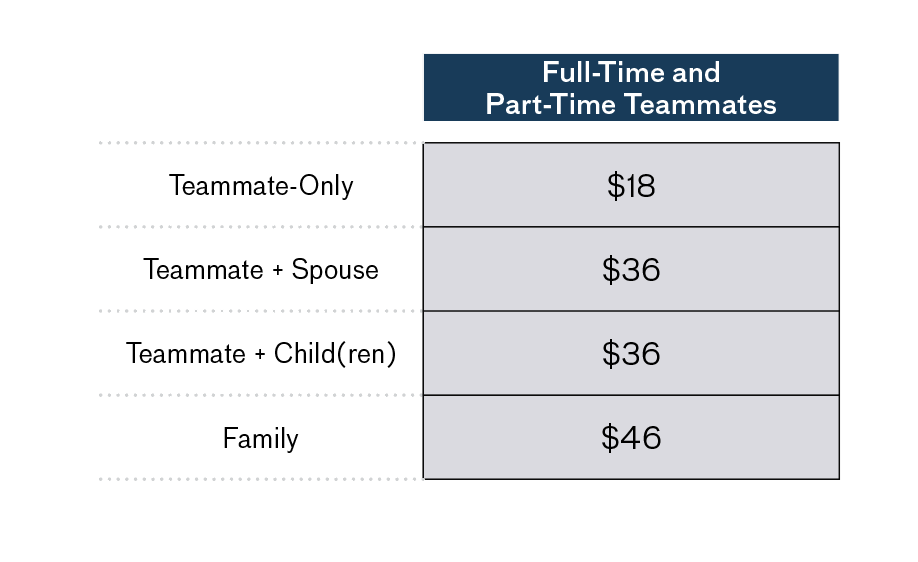

Full-time and part-time employees have the same costs for this coverage.

Pre-tax contributions are allowed under Section 125 of the Internal Revenue Code. Your share of the medical and dental contributions is taken out of your pay before federal, Social Security and most state and local taxes are calculated. As a result, your take-home pay is higher because you pay less in taxes. You also may pay less into Social Security, and your Social Security benefit could be slightly reduced. Your pre-tax contributions do not appear as part of your taxable wages on your W-2 Form. The pre-tax contributions do not affect other Floyd benefits that are based on your pay. Those benefits, such as life insurance and disability benefits, will continue to be based on your regular pay.

*Deducted 26 times per calendar year.